2019-02-22 8923Secondary browse

Share to: Heavy weight | holliday releases 2019 precious metals forecast report

Holliday, the world's largest provider of precious metals products and services, is forecasting an overall bullish outlook for 2019, despite some volatility in precious metals prices. Trade conflicts between China and the United States, brexit in limbo, protests in France, slowing global growth, volatile capital markets -- and increased economic and political uncertainty around the world -- led to strong demand for gold and silver in 2019. Industrial palladium demand growth is also strong, which will drive prices higher. Platinum prices will rise modestly despite relatively weak demand.

Precious metal price range.

Precious metal range

Gold, $1,225 - $1,450 per ounce

Silver $14.50 - $20.00 per ounce

Platinum $700 - $950 per ounce

Palladium $1,130 -- $1,650 an ounce

Rhodium 2,000 -- $3,250 per ounce

Ruthenium 200 - $350 / oz

Iridium $1,150 -- $1,750 per ounce

Holliday precious metals has collaborated with internationally renowned precious metals consultancy SFA (Oxford) Ltd to prepare the 2019 precious metals forecast report.

The main contents of the precious metals forecast report are as follows:

Gold became a safe haven asset

There are several signs that gold prices could rise in 2019. With capital markets in turmoil, investors are increasingly turning to less volatile alternatives. Central Banks in advanced economies have pursued unconventional monetary policy for years. The fed seems to have been the first to pull back from its zero interest rate policy and return to normal interest rate conditions, but it now looks as if it has become cautious again. A temporarily weak dollar could provide support for gold prices. The overall situation could lead to unexpected market tensions, and gold can be used as a hedge against currency volatility. In addition, global economic and political uncertainty is on the rise: the UK begins the process of leaving the European Union, trade conflicts erupt between China and the us, the us government shuts down and Italy falls into recession... Factors such as these are slowing global growth. Central Banks are piling into gold, supporting demand. Gold is expected to fluctuate between $1,225 and $1,450 an ounce in 2019.

Silver and gold moved in tandem, rising faster than gold. In uncertain times, silver and gold prices were affected by essentially the same factors. In addition, there are other signs that silver prices will outpace gold in 2019. Potential demand for silver in the industrial sector is growing: silver is an indispensable material for the photovoltaic industry. Despite the emergence of photovoltaic products with lower silver content and higher efficiency, a large number of new photovoltaic installations in many regions will stimulate the growth of demand for silver. Silver is also essential in growth areas such as in-car electronics, smartphones and tablets. On the investment side, silver supply fell last year, with holdings in silver etfs falling 280 tonnes.

At present, the gold and silver ratio of 83, also reflects the above market situation. As a result, silver is undervalued relative to gold. Historically, the 80 + gold and silver ratio has never lasted much longer. Silver prices are expected to fluctuate between $14.50 and $20.00 an ounce as demand picks up in the current market environment.

Platinum is still in oversupply and the strike has temporarily supported prices, a situation that will continue as diesel demand falls. The auto industry is the biggest market for platinum, accounting for 42 percent of total platinum consumption. Platinum is mainly used in diesel three-way catalytic converters. The jewelry sector's platinum demand will remain at 25 percent of the total, though it is also at risk of a downturn. Demand for platinum has risen slightly because of its widespread use in refineries, particularly in China and the us, and as a catalyst for chemicals.

Platinum production from minerals such as South Africa is likely to rise by 1%. A potential strike over wage negotiations in the mining industry could temporarily raise platinum prices. Platinum recycling production is growing modestly this year. Overall, platinum overcapacity is expected to reach 21 tonnes in 2019, compared with 207 tonnes in 2018. A strong correlation with gold could temporarily support platinum prices. Platinum is expected to fluctuate between $700 and $950 an ounce.

Second, palladium is still in short supply, prices are expected to shock higher

Demand for palladium will continue to outstrip supply in 2019, with ETF stocks down to about 20 tonnes. The auto industry is the biggest consumer of palladium, accounting for 81% of the total. Palladium is mainly used in gasoline three-way catalytic converters. Palladium demand will increase further as China's auto market grows slightly and stricter emissions regulations are implemented. While production growth in minerals and recycled palladium slightly outpaced demand growth, there was still a 17-tonne market gap. A strike by South African miners could exacerbate the shortage. That could improve if growth slows in China and the U.S., the two biggest auto consumers. Palladium prices are expected to fluctuate between $1,130 and $1,650 an ounce, given ongoing supply shortages.

Iii. Medium - and long-term development trend of precious metal industry

Two trends affect the development of the precious metals industry in the medium to long term:

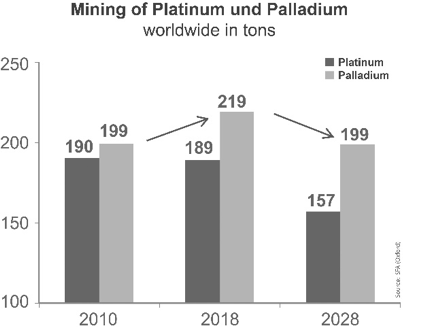

1. Production of platinum and palladium will decline in the next decade. The recovery and utilization of platinum group metals will become more and more important. Due to low prices and the high and growing cost of mining, the industry has been consolidating over the past few years, particularly in the area of platinum group metals.

2. Upgrading of mobile power system technology leads to low demand for platinum. With the development of fuel cell technology, platinum demand will return to the track of rapid growth. Platinum will continue to be in oversupply for the next decade, thanks to the fallout from the Volkswagen emissions scandal and the end of the need for platinum in connection technologies. However, platinum, originally used in ternary catalytic converters, is also the main catalyst for hydrogen technology. Hydrogen technology, which powers cars and stationary motors but can also be used to store energy, will boost platinum demand. But hydrogen technology may not have an increasingly significant impact on platinum supply and market prices until 2030. Global sales of electric cars, by contrast, have increased, but growth in car sales over the next decade will boost palladium demand. As a result, the increase in gasoline and hybrid vehicles could easily make up for the decline in palladium usage caused by the increase in pure electric vehicles.

Investment in precious metal recovery and hydrogen energy technology

In line with both trends, holliday precious metals is investing to expand its precious metal recovery capacity in Germany, the us and Asia. In China, heraeus precious metals has built the world's largest and most advanced precious metal recycling plant in September 2018. "We can now recover more than 100 tonnes of platinum and palladium a year. Compared with mining, precious metal recovery can significantly reduce carbon dioxide emissions and energy consumption. "Precious metals recovery is playing an increasingly important role in bridging the gap between shrinking mine production and demand for precious metals. Andre Christl, President of the precious metals business unit at heraeus technologies group in Germany. Hollis is also investing in a variety of new technologies, including hydrogen technology.

V. disclaimer

The 2019 holliday precious metals forecast is compiled using information from sources considered reliable but not independently verified by holliday and UK's SFA (Oxford) Ltd. Although the 2019 holliday precious metals forecast is carefully compiled, holliday and SFA (Oxford) Ltd assume no responsibility or obligation for the accuracy, completeness and current relevance of the information contained in this forecast. In addition, any forecast of precious metals in this forecast (including any forward-looking statement) is based on the expectations and assumptions of holliday and SFA (Oxford) Ltd as of the date of preparation of this forecast. Actual results may differ significantly from this forecast due to risk, uncertainty and a variety of other factors beyond the control of holliday and SFA (Oxford) Ltd. Therefore, there is no guarantee that any forward-looking statement will be fulfilled. Holliday and SFA (Oxford) Ltd do not undertake to update any forward-looking statements to reflect developments that are different from expectations.

Last article:Palladium, never simple - Russia's 'game of thrones'

Next item:Platinum group metals

陕公网安备 61030502000254号

陕公网安备 61030502000254号